Best PayPal alternatives: Started in 1998, PayPal has come a long way and in the third quarter of 2018 had more than 240 million active users. All the inconveniences related to using cheques and paper money have been eliminated by it, as you can do a lot through its online payment system. In the last few years, PayPal has become one the most popular and commonly used online payment platforms. In 2012 PayPal’s payment volume was $150 billion, In 2018, the volume was $578 billion and in 2019 PayPal hit a record with a payment volume of $712. Thus, in a short period, PayPal just only made its name but also shows the world how much potential it has.

Why Go For PayPal Alternative?

Well, here are some key drawbacks of PayPal:

- PayPal is awesome but it is not the only option available out there.

- There is no protection provided from PayPal for the sellers offering digital services and products.

- PayPal Charge 3.7%+ $0.30 roughly for every transaction, while some alternatives charge lower fees than PayPal

- Your PayPal account can be freeze from their side for up to 6 months with any warning in advance. Though they do it for a reason, you don’t get any warning.

- It takes 3 to 5 days approximately to withdraw money or funds to your bank which considerably long and other platforms offer real-time transfer according to their claim.

Besides, in India because of some disputes between the Reserve Bank of India and PayPal, the operation of PayPal will discontinue. So it is really important for those who have to do a lot of international transactions to look for alternatives for PayPal. So, in this article, we will tell you about some good alternatives available to help you figure out which one is best for your business and yourself.

Dozens of sites and platforms are similar to PayPal out there with fewer or more features. We will discuss some of the best money or fund transfer sites that we have found while searching for some good sites for sending and receiving money internationally and locally, and these can be proven good alternatives to PayPal. Each brings something different in your hands, so the best alternative precisely depends on the individual user according to the nature of its personal or business use and online money habits. So without wasting further time let us begin!

Best PayPal alternatives

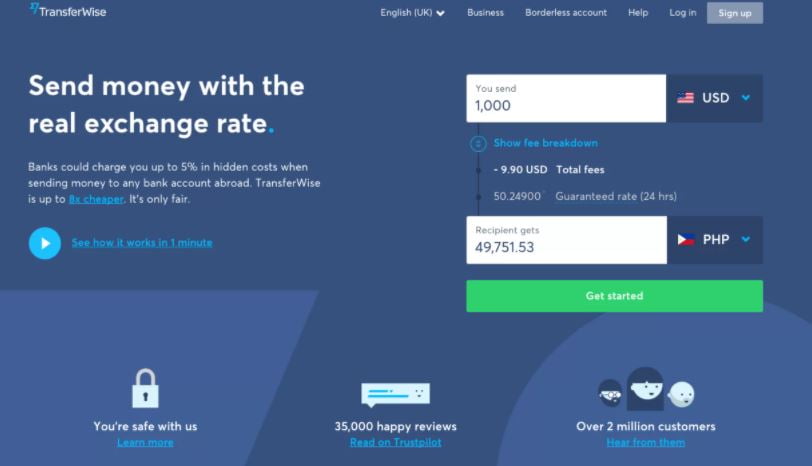

1. TransferWise

For those individuals or service-based businesses who have a high volume of transactions internationally then TransferWise is for those.

TransferWise as the name suggests is a wise option to transfer money internationally on the cheap. It was developed by Richard Branson and other people behind Skype.

Moreover, TransferWise claims to offer a real-time transfer rate with any hidden fees. Say, for a transaction of $2000, it charges only £106.47 which is less than PayPal. For USD to EUR transfer, only 0.6% of the transfer amount plus $1 is charged by TransferWise.

With the business account of TransferWise, you can invoice your customers in their currency. Along with this, there is a service called Borderless Account, in this TransferWise provides you a Debit card with which you can operate with more than 40 currencies, charge clients, batch payments, run payrolls, and more.

You might prefer TransferWise over PayPal because you would not lose any money in currency conversion or because of their low transaction fees & currency conversion charges.

So the question is how TransferWise provides international transfers at such low fees? So, suppose you want to transfer $1,000 to your friend in the United Kingdom. Ultimately your $1,000 would be deposited into the American account of TransferWise. Then, the equivalent amount of $1,000 in British pounds would be sent to your friend from TransferWise’s UK account, using the real exchange rate.

Because of low transaction fees and currency conversion charges you might prefer TransferWise as an alternative to PayPal.

To know more about TransferWise and how it works you can watch the below video.

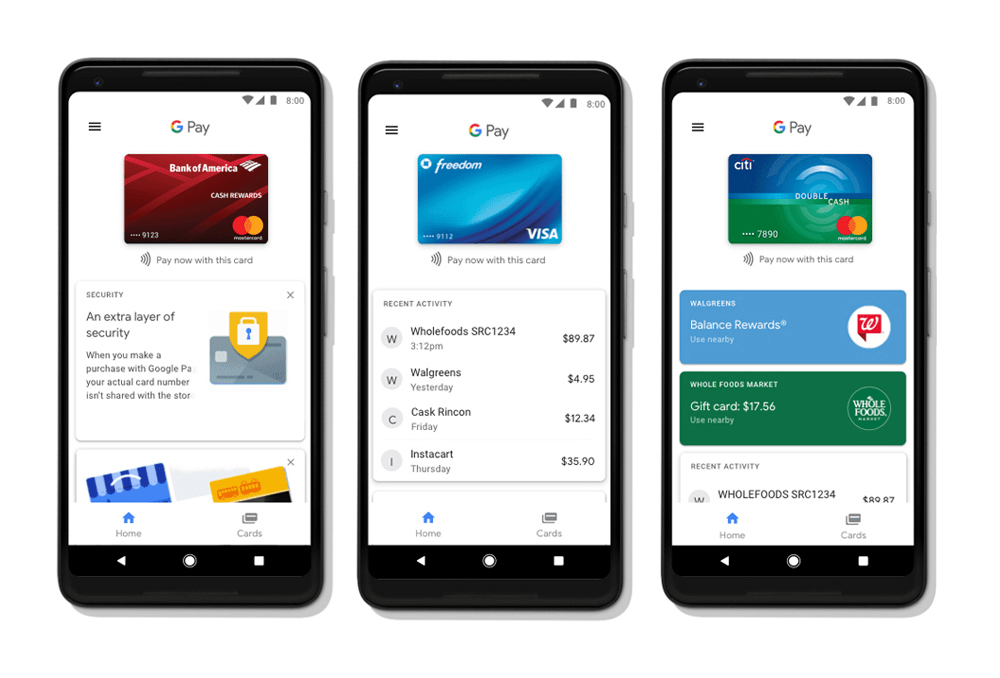

2. Google Pay

Google Pay, popularly known as GPay, comes from the developers of Google Inc. and is another alternative for PayPal.

It provides a simple and fast way to make payments in apps, on websites, and in shops and stores by the cards saved in your Google Pay account. Add your debit and credit card by just entering card details and enjoy convenient payments. Payments through debit cards and bank transfers are free, but for payments through credit cards, 2.9% of the transfer amount is charged by Google Pay.

There is no cancellation and set up fees for Google Pay. Also in local shops and vendors, you can even pay by scanning a QR code.

Besides, it is really easy to combine Google Pay with any website, app, or e-commerce store, and others. And you also get emails related to payment and transactions in your Gmail account for the surety of your payment transaction.

To know more about the functionality of Google Pay watch the below video.

Download App: iOS- Android

3. Stripe

Just like the above two, Stripe is also a popular alternative for PayPal. Stripe is only for online or internet businesses. Payment problems are “rooted in code, not finance” with this spirit this payment platform considers itself a “developers first” business.

Stripe’s services are available in 43 countries (https://stripe.com/global ) including Australia, Belgium, Switzerland, and others. But if your country is not on this list and Stripe is not operating in your country then don’t get low. With the Stripe Atlas program, you can incorporate your company in the USA and can even open a bank account for you

Unfortunately, the fee structure of Stripe is almost similar to PayPal. For every transaction, it charges 2.9% of the transfer amount plus 30 cents, and there are no sign-up or monthly fees. Unlike PayPal, the checkout process is self-hosted and takes place on the business site itself without redirecting customers to an external site. Another interesting thing is that Stripe also accepts payments in Bitcoins.

This automatically deposits the fund or money into your or an outside bank.

ULTIMATELY, Stripe’s strength and the advantage lies in its customizable nature and flexibility. Somehow this could be a problem for those who are not much into programming.

To know more about the functionality of Stripe watch the below video.

READ MORE: Upcoming Gaming Events Of 2021 You Can Participate

4. Payoneer

Another popular alternative for PayPal is Payoneer. Whether you are a freelance, professional, or a business owner, with Payoneer you can get paid securely, quickly, and at low cost by international clients. Payoneer started around the same time as PayPal and with 4 million users it operates in more than 200 countries. According to some reviews, it is good for small and medium-sized businesses.

It offers two types of accounts, one that allows you to withdraw money directly into your account for free. In other types, you will get a prepaid card for $29.95/month. The transactions between Payoneer to Payoneer account are free. To make payments to those who do not have a Payoneer account, have to pay a fee of 3% for credit card transactions and 1% for e-checks. At the time of the transaction, you have to pay up to 2% above the market rate while withdrawing funds or money from your local bank account, and $1.50 to withdraw funds or money from another bank in the same currency.

Payoneer allows single or mass payouts, as well as the ability to receive payments and withdraw funds. It has a partner network and supports integrated, third-party, and escrow payments. Payoneer also includes API support.

To know more about the functionality of Payoneer watch the below video.

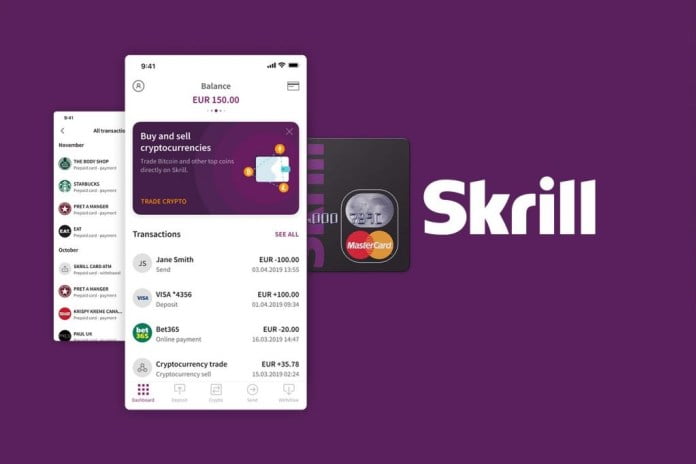

5. Skrill

Skrill is like PayPal and Payoneer but because of its low currency conversion rate and other features, it is one of the worthy alternatives for PayPal. Where PayPal charges 4.5% for a trade transaction while Skrill charges only 2.9%. Withdrawal of money from a bank account is free but to send and receive funds, Skrill charges 1.45% of the transfer amount plus $0.50.

Skrill offers global support in over 30 countries. The service is super simple to use and you can receive and send money, link your bank accounts, for faster purchasing you can add your card details and can pay by just entering your username and password. Skrill offers a simple API, advanced fraud management, multiple integrations, protection, and chargeback. With one tap feature, it gives you an experience of frictionless payments as you can make repeat payments with a single touch. It also offers multilingual customer service, analytics, and advanced reporting, and multi-currency accounts.

On Skrill, you can also do transactions with cryptocurrencies because initially it was developed for cryptocurrencies such as Bitcoin, Ether, and Litecoin, and others. Moreover, it is also used for many gambling games which require money to play.

However, Skrill has one drawback which is its inactivity fees. If Skrill accounts are not used for 1 year straight, then $5 is deducted as a fine.

To know more about the functionality of Skrill watch the below video.

6. 2CheckOut

For those who are looking for a payment platform for their business that works in various countries, languages, and currencies the 2CheckOut is for them.

2CheckOut offers its services in 87 currency options, 8 types of payments, 30 languages in over 300 countries. And for every transaction, there are more than 300 fraud checks. You have no problems accepting payments no matter where your customers are.

You’ll get three pricing plans, 2SELL, 3.5% + $0.35 per successful sale; 2SUBSCRIBE, 4.5% + $0.45 per successful sales; 2MONETIZE, 6.0% + $0.60 per successful sale, and you can choose any one of them as per your need.

Download Here: https://www.2checkout.com/

7. Shopify Payments

Shopify Payments is the Option that you can look at as an alternative for PayPal. This can combine with your store easily and has a name in expertise in the e-commerce industry. With Shopify Payments, you can easily use your credit and debit cards in Shopify Stores without any third-party application.

Amazon, eBay, Facebook Shops, Facebook Messenger, Pinterest Buyable also supports Shopify Payments.

There are different plans and you can choose as per your need. Basic Shopify, $29/month, online credit card rates of 2.9% + .30 cents, in-person credit card fees of 2.7% + .0 cents, and 2% additional fees for non-Shopify payment providers; Shopify, $79/month, online credit card rates of 2.9% + .30 cents, in-person credit card fees of 2.5% + .0 cents, and 1% additional fees for non-Shopify payment providers; Advanced Shopify, $299/month, online credit card rates of 2.4% + .30 cents, in-person credit card fees of 2.4% + .0 cents, and 0.5% additional fees for non-Shopify payment providers.

What to consider when evaluating PayPal alternatives

Different features and services will work best for different businesses, but there are a few things each user or company should consider when evaluating which PayPal alternative will best suit their needs:

Different businesses need different features and services which will work best for them, but there are a few things that are common in all and each company and user should consider and ponder over these things when evaluating which PayPal alternative will best for their needs and requirements.

- Transaction fees

How did that alternative cost you for different money transfers and transactions?

- Monthly fees

How much do you have to pay for it in a month and does it give you special and exceptional services for that monthly subscription?

- Special services

Does it provide something extra and special that you will not get from any other alternative?

- Integrations Capability

The alternative that you chose does easily integrate and work well with your online business?

The bottom line

PayPal has its benefits and perks but if somehow you are not comfortable with PayPal or not able to use it then there are plenty of other options available that you could use as an alternative to PayPal, and all of them have their drawbacks and strengths. Which platform is suitable ultimately depends on you, your needs, and what your business wants.

Tell us below in the comments which platform will you choose as an Best PayPal alternatives.

READ MORE: How To Buy Instagram Blue Tick Or Verification Badge